- Bloo Mondays Newsletter

- Posts

- Happy Bloo Monday 💙!

Happy Bloo Monday 💙!

Welcome to Bloo Mondays,

This weekly newsletter for businesses owners, organisations, team members and solo entrepreneurs (freelancers) — designed to add some colour to the Monday blues and replace it with a touch of Bloo 💙.

Each week we’ll share tips, insights and maybe a meme or two to spark some ideas. So let’s jump right in.

In this week of Bloo Monday’s we’ll be covering:

💙 Why We Started Bloo Money — the story behind how we set out to solve a problem we faced ourselves

💰 The True Cost of Financial Admin — How managing finances manually can drain time, energy, and money from your business

🎤 Mi Casa Music x Bloo — a look at how the music group and their management team is using our app with their creative freelancers

🗓️ The Bloo Grape Showcase — Filmmakers and producers — save the date! We are hosting an exciting event soon!

Why We Started Bloo Money

Sabica and I, didn’t start out building software — we were dreamers working on exciting projects.

For myself this was a youth impact non-profit called Young Aspiring Thinkers which impacted over 5 000 young learners in township based schools through funded programmes in partnership with organisations such as Oracle, BCG, Trevor Noah Foundation and others.

At the same time, Sabica — a freelance artist — was completing her Master’s in Digital Business at Wits Business School. She was studying South Africa’s startup landscape and tech ecosystem while juggling freelance gigs, running a student consultancy, and navigating the hustle of creative work.

Like many dreamers, we were freelancing on the side, trying to earn a bit extra — and more importantly, trying to get paid on time.

In 2021, Sabica and I would often chat, and one recurring complaint kept coming up: freelancing meant constantly chasing late payments, losing track of invoices, and dealing with messy client admin.

So we thought: what if we built an app to help freelancers get paid faster?

That was the beginning of Bloo (formerly known as Moya Money for some of the real ones in our community).

But as we dug deeper, two major things happened:

Businesses were struggling too.

We spoke to dozens of businesses who were trying to manage freelancer invoices with spreadsheets, WhatsApp threads, and emails. Payments were delayed not because of bad intent — but because admin was a challenge.We also experienced the problems businesses were talking about ourselves after raising funding to build the first version of the Bloo Money app

Once we secured investment we hired freelancers ourselves — developers, creatives, social media specialists. Within months our budget was in disarray because;Every supplier had their own invoice format

Our bank app and spreadsheet were not linked making it hard to track planned vs actual spending.

We were manually copying and pasting banking details

We had to send a monthly report to our funders which took far too much time to compile

We felt like we were just drowning in pdfs, payments all over the place and emails from freelance suppliers.

Sabica and I, fighting the admin chaos of invoices, documents and payments in 2021

That’s when it hit us: we’re first-time business owners, just like many others.

We don’t have finance teams.

We don’t have time (or quite honestly the money) to make these mistakes or else.

So we built Bloo Money — an app for founders, business owners and freelancers like us.

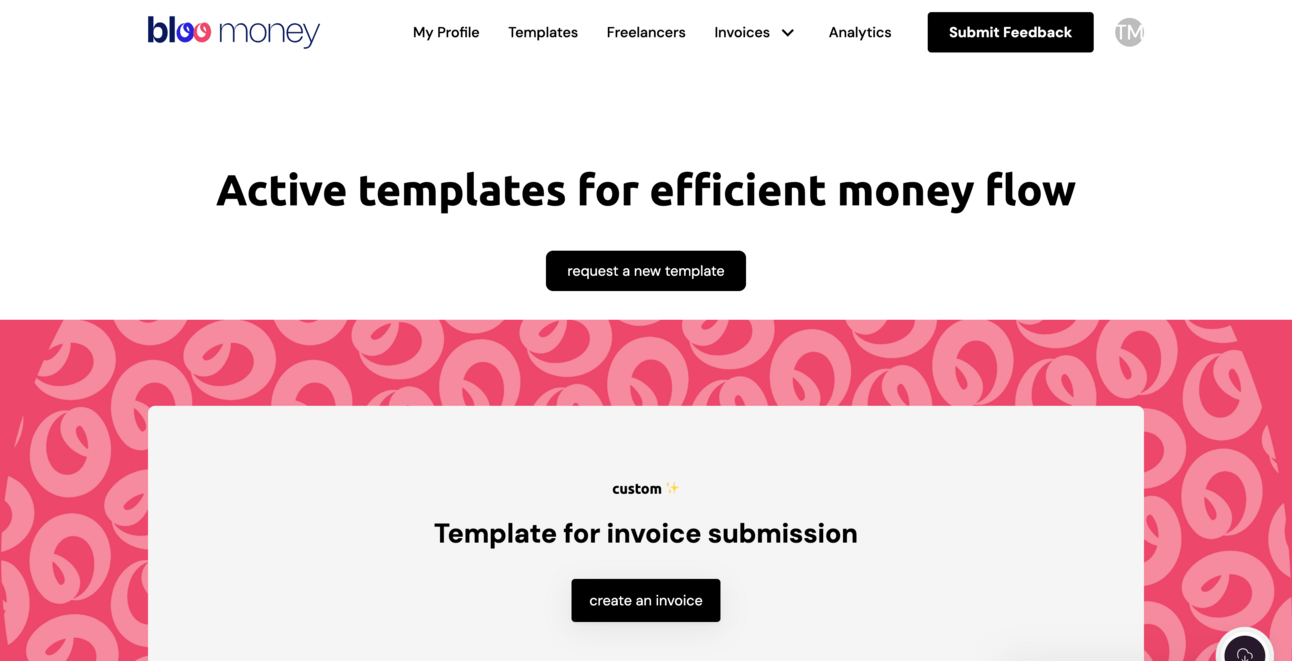

Our app is designed to replace the manual spreadsheets, remove back and forth email threads, ensure correct invoices on time and allow payments to be approved. All in one place where we could both see what’s going on.

The best part? Freelancers and suppliers can use the app for free is we can give the app for free. They can submit their information, track their payments, and get clarity on when they’ll be paid — no chasing or asking about payments needed.

We are on a mission to empower business owners and teams with their own financial assistant — one that helps them understand how they’re spending money when working with freelancers and suppliers. To paint a picture of their finances on projects.

We want to make finance fun, simple, and colourful — giving teams the feeling that managing money is more like painting on a canvas - creative, clear path to bringing their vision to life when it comes to managing finances.

Sabica and I, nowadays whenever we have to spend money for our business. It feels like our vision is coming to life.

Most businesses don’t start with a finance team. We do it all ourselves.

If you're running a production company, agency, NPO, or startup — chances are, you're juggling project deadlines and payment chaos.

Let’s be honest:

You never asked to be your company’s finance person — but as the business owner, you had to take on the role anyway.

You’re managing 15+ freelance suppliers, each with their own invoice format.

What used to be manageable in spreadsheets has now become overwhelming. You're running multiple projects at once, with a growing network of freelancers and suppliers to keep track of in your database.

The truth?

Not having proper financial admin systems is costing your business time and money. We learnt this the hard way so other businesses don’t have to.

According to Sage, South African businesses spend 202 days a year on financial admin tasks such as — invoicing, paying taxes, chasing or making payments and issuing payslips.

The challenge is that more than 50% of small businesses in South Africa employ a team of 2-5 people and rely on accountants primarily to file annual returns or monthly bookkeeping.

Translation: most small business doesn’t have the budget—or need—for a full-time finance hire to assist them with day to day finance tasks on projects that eats up time.

So the responsibility of chasing freelancers invoices or tracking budget on a spreadsheet falls to the business owner or someone else on the team.

🎧 Watch Our Demo: How We're Helping Teams Like Mi Casa

You probably don’t need an introduction to Mi Casa — the award-winning South African house trio behind hits like “Jika” and “Mamela.” But behind the music, their operations need to run just as smoothly as their sound.

Their management team uses the Bloo Money app to:

Create projects for tours, gigs, and brand collaborations

Collaborate with freelancers — from session musicians to stylists and videographers — submit invoices with zero friction

Approve and track payments — all in one place, with no more WhatsApp reminders or Excel fatigue

We promise you this is not AI

💡 For a band that’s constantly on the move, Bloo helps to keep their behind the scenes tight—so they can focus on the front stage.

Watch our 2min product demo below so you can see what Bloo can do for you and how we automate invoices for businesses like Mi Casa.

It’s Easy Try It Out For Yourself:

Getting started → – Set up your first project in under 10 mins

Book a call with us → – Let’s chat if you’d like to learn more

🗓️ Coming Up Soon: Bloo Grape Film Showcase

We’re excited announce our Bloo Grape Film Showcase 🎬 A fusion of film, fintech, and creative community.

We’ve partnered with Grapefruit Gardens for a unique event to impact the next generation of South Africa film makers. Selected indie film makers will have the opportunity to showcase their short films at The Bioscope Cinema in front of an audience of +50 industry professionals.

What you get out of it:

🎥 Screen Your Short Film — Present your work on the big screen at The Bioscope.

💼 Creative Finance Workshops — Learn practical tools and insights to grow your production company or creative career.

🤝 Network with Industry Pros — Connect with fellow storytellers and key players in the film and media space.

🏆 Receive Expert Feedback — Have your work reviewed by a panel of Oscar-shortlisted directors and producers with experience creating for Netflix, Multichoice. They’ll also be awards!

🔥 Let’s connect

That’s it for this week folks and looking forward to seeing you again next week Monday.